Gold prices traded over 1% lower near $2,380 on Wednesday as mounting expectations for further interest rate hikes by the Federal Reserve and other major central banks diminished the precious metal’s allure as a non-yielding asset.

Fed policymakers have reiterated their resolute stance, stating that more progress is needed to tame stubbornly high inflation before any pivot to lower rates can be considered. With interest rates rising, the opportunity cost of holding gold increases, weighing on its pricing.

The sell-off in gold intensified ahead of the latest Federal Open Market Committee (FOMC) meeting minutes due later today at 6 PM GMT. Market participants will closely scrutinize the minutes for clues on the Fed’s policy outlook, with a more hawkish tone likely to extend gold’s pullback.

Other major central banks are also turning increasingly hawkish amid persistent inflationary pressures. The latest meeting minutes from the Reserve Bank of Australia revealed officials had contemplated raising rates further, marking a notable shift from their previous dovish bias.

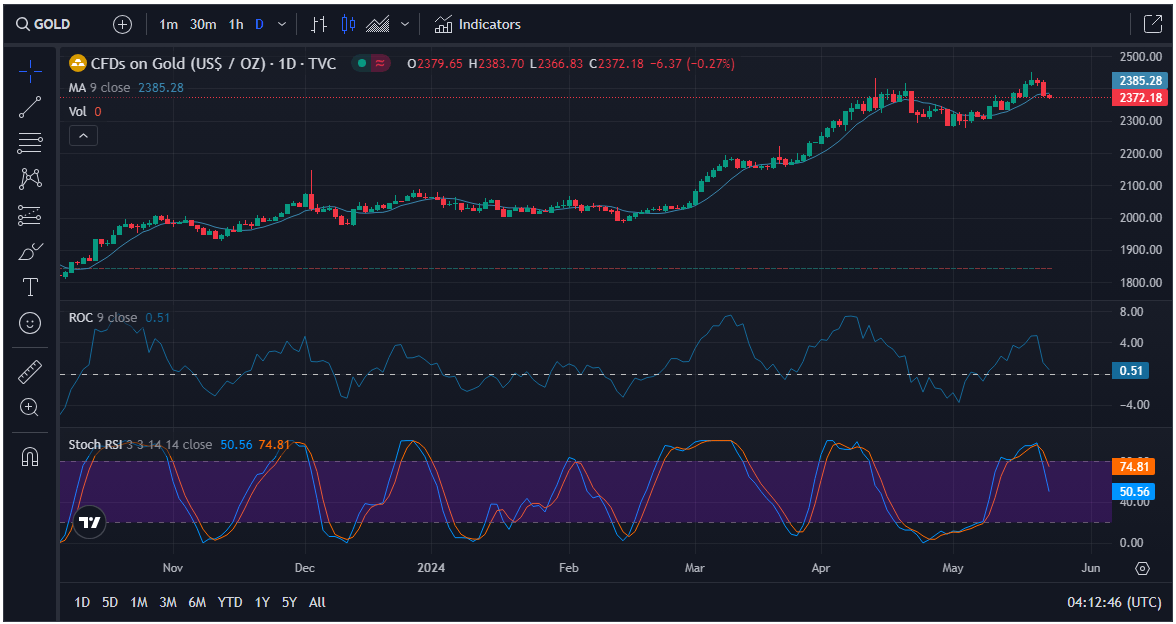

Gold Prices Face Key Technical Test at Trendline Support

From a technical perspective, the precious metal has broken below a key short-term uptrend, depicted by the green trendline, after forming a bearish “Shooting Star” candlestick pattern earlier this week.

Should the corrective move gain momentum, the next critical support lies at the upward-sloping dark grey trendline near $2,360. However, given gold’s overarching bullish trajectory across multiple timeframes, any dips may be viewed as attractive buying opportunities by long-term investors.

A decisive breakout above the new all-time high of $2,450 could pave the way for a continuation rally, with the psychologically significant $2,500 level emerging as the next key upside target.

As central banks globally remain committed to aggressive policy tightening to restore price stability, gold’s trajectory will largely hinge on the evolving interest rate outlook and its impact on the non-yielding metal’s relative appeal.